As an AI-based solution designed to empower businesses with advanced data analytics and tax inspection preparation, BALTHASAR recognizes the transformative impact of artificial intelligence (AI) in Tax Administrations (TA). In this article, we will explore some of the noteworthy use cases of AI in Tax Administrations, as highlighted by the Inter-American Center of Tax Administrations. These use cases shed light on the ways AI is revolutionizing tax administration processes and delivering valuable outcomes for both the public and private sectors.

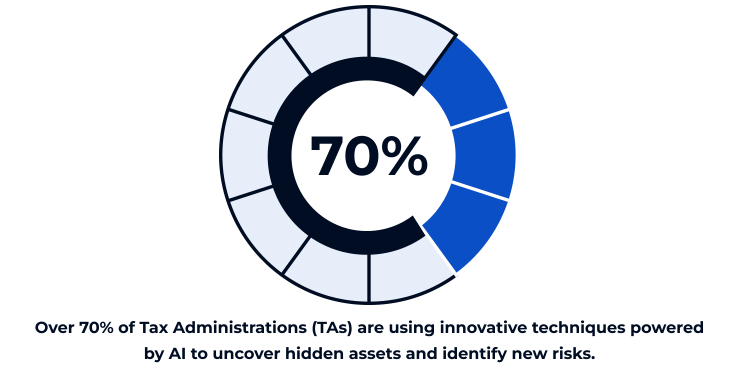

Uncovering Hidden Risks and Improving Risk Management: AI has become instrumental in enabling Tax Administrations to identify previously hidden risks and enhance their risk management capabilities. Through innovative techniques, TAs can leverage AI’s data analysis and machine learning capabilities to detect patterns and anomalies that may indicate potential non-compliance or fraudulent activities. By automating risk assessment processes, TAs can more efficiently allocate their resources and focus on addressing high-risk areas.

With the emergence of the highly relevant “Tax Administration 2022” report by the OECD Forum on Tax Administration (FTA), it becomes evident that Tax Administrations (TAs) are increasingly comfortable handling large data sets and leveraging improved computing power. This growing comfort level has led to the adoption of AI and machine learning, enabling TAs to explore novel approaches in risk management. According to the survey, over 70% of TAs are already utilizing innovative techniques to effectively analyze data, revealing concealed assets and identifying emerging risks.

Efficient Taxpayer Registration:

AI is streamlining taxpayer registration processes, making them more efficient and accurate. One notable example is the implementation of AI in the company registration process in Sweden. By employing AI algorithms that classify registration requests based on predefined risk factors, TAs have significantly reduced manual categorization efforts. The introduction of AI-based risk assessment services has led to substantial time savings and cost reductions, enabling TAs to process registrations more swiftly.

Efficient Taxpayer Registration:

AI is streamlining taxpayer registration processes, making them more efficient and accurate. One notable example is the implementation of AI in the company registration process in Sweden. By employing AI algorithms that classify registration requests based on predefined risk factors, TAs have significantly reduced manual categorization efforts. The introduction of AI-based risk assessment services has led to substantial time savings and cost reductions, enabling TAs to process registrations more swiftly.

Predictive Behavioral Insights:

AI enables Tax Administrations to predict taxpayers’ behavior by leveraging behavioral insights. In Brazil, the Behavioral Insights Project conducted tests using different behavioral science techniques in personalized letters sent to small companies that experienced increased earnings during the pandemic. The results demonstrated the impact of incorporating behavioral techniques on compliance behavior. These findings are now being utilized to develop AI-powered systems that predict the most effective communication strategies for individual taxpayers.

Improving Taxpayer Services:

AI-based virtual assistants are transforming taxpayer services by providing personalized guidance and support. Tax Administrations in various countries, including Spain, Canada, the United Kingdom, and Brazil, have adopted virtual assistants that leverage AI to deliver tailored assistance to taxpayers. These virtual assistants enhance the user experience, simplify processes, and promote efficient digital transactions.

Integration into Compliance Processes:

AI is playing a crucial role in integrating compliance processes within Tax Administrations. By leveraging AI’s capabilities, TAs can automate compliance management and risk assessment tasks. The Canada Revenue Agency (CRA) has empowered its assurance and advisory professionals by utilizing AI to streamline compliance processes and enhance risk management. This integration ensures that tax compliance is more efficient, accurate, and aligned with evolving regulations.

The use of artificial intelligence in Tax Administrations is transforming tax administration processes, enabling efficient risk management, taxpayer registration, asset detection, and compliance management. By harnessing AI’s advanced analytics, machine learning, and automation capabilities, TAs can enhance their efficiency, accuracy, and service delivery. BALTHASAR recognizes the immense potential of AI in empowering businesses and government entities, and we are committed to providing advanced data analytics and tax inspection preparation solutions to cater to their evolving needs. The integration of AI in Tax Administrations is paving the way for a more effective, streamlined, and compliant tax ecosystem.